As If You Didn’t Know

Well, here’s the proof from Zero Hedge.com (Read whole article here)

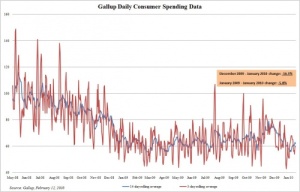

Gallup Consumer Spending Data Refutes Commerce Department January Retail Sales Announcement

Submitted by Tyler Durden on 02/12/2010 13:21 -0500

As if anyone needed more reasons to doubt the data coming out of our government. Earlier today the Commerce Department reported that January retail sales data came at a nice and bubbly 0.5% sequential increase, and an even nicer and bubblier 4.7% YoY. This presumably beat expectations which were looking for a sequential beat of 0.3%. Yet here comes the much more reliable Gallup data to throw some salt in yet another economic data fabrication. According to daily Gallup consumer polling, which due to its lack of proximity to the government propaganda complex is vastly more reliable, the January average data showed a decline of 5.8% over January 2009 and a whopping 16.3% decline over December. This is beginning to parallel the ever increasing divergence between the ABC consumer comfort index and the UMichigan index which lately seems to only track the average level of the S&P over the prior month.

The chart below shows the true consumer spending behavior of Americans.

The gallup methodology is much more accurate than anything that could possible come out of the Commerce Department with its infinite data “adjustments.”

If you’re in the business of selling stuff, now you know why sales aren’t so hot. The problem is not you, its our lovely government which seems incapable of telling the truth about ANYTHING.

Notice what the graph at left has to say about the notion of a recovery and a double-dip recession. Do you see any recovery there? Ignore the spikes, those are holiday sales.

Why Tiny Greece Matters

Its true that the debt problems of the tiny Greek economy seems all out of proportion to the fears it has struck in the world markets. Friday saw a lot of people trying to downplay it, noting that the economies of Greece and Portugal are only 2% and 1% of EU GDP respectively. Even Jim Puplava was making that argument yesterday. But the shockwaves sent by the Dubai default, which was even smaller, are establishing a pattern here.

The size of the economies involved is not the issue. What lies behind it is the Domino Theory that involves the interconnectedness of a handful of world megabanks that not only hold those loans, but also have issued most of the CDS insurance on those bonds, as well as interest rate swaps such as JPMs over $70 trillion worth of interest rate derivatives.

Governments around the world with the US in the lead, are making the same many of the mistakes made during the Great Depression. To wit, raising taxes on a sinking economy while grossly manipulating markets. Sinking back into recession means declining tax revenues are very likely to push marginal nations such as the PIIGS over the edge and into default. European banks made most of those loans and hold the bonds. US banks insure them, along with interest rates. The raising of taxes almost guarantees that the world economy will slide back into recession (assuming one believes that we ever got out, which most don’t).

If this isn’t a perfect set up for a domino chain reaction of crisis, I don’t know what is. And add to all this the fact the insolvency not only of the mega banks, but now national governments, has been papered over. Not only has virtually none of the structural problems that caused the present state of affairs been repaired, these problems have been made far worse. This fact has been thoroughly revealed, discussed and ignored over the last two years.

The contagion in southern Europe poses a severe risk of an all-out financial plague breaking out. It threatens not only the Euro but the entire EU itself. Most bets are on the probability that the EU will have no choice but to bail out Greece and Portugal, which will only incite the remaining and larger PIIGS to come a-begging to the ECB. So, where does it stop? Were not talking about bailing out mere banks here but a half dozen nations, which could easily wreck the Euro and lead to an even greater currency crisis as the world’s second largest currency.

So what we have here is tiny Greece being akin to the assassination of Archduke Ferdinand (who?) starting WWI when nobody even knew who the hell he was. The proverbial straw that breaks the camel’s back. And yet world banks and economies are so fragile that the current situation can be likened to a hemophiliac walking through a briar patch desperately try to avoid being scratched and bleeding to death. The probability of not getting scratched while picking blackberries is pretty slim.

LIARS

The US Federal Reserve is so conditioned to lying that they’re no longer aware of their own lies. Here is the ultimate irony, proof of their lies contained within their own presentation. This comes in two parts, so first here are the words.

“The 2007-2009 recession is widely thought to have ended sometime last summer. How bad was this recession, and how quickly is the economy recovering? How does this recession and recovery compare to previous cycles?”

Now cometh the proof,

This is truly mind boggling. Their own graph shows the “recession” still deepening yet they would have us believe otherwise.

Can’t Catch a Break

The beleaguered boating industry just can’t catch a break. Just when oil prices appear ready to start falling, they reverse and start heading higher. And yet despite falling from a recent high of $80 down to below $73, gasoline prices have not abated. Just in the last two days wholesale gas has risen 15 cents while oil has remained flat.

Year over year, gas is up over 33% on average. That’s not going to do anything good for the so-called recovery. Word is that all those tankers sitting idle storing oil is being rapidly sold off, bringing down inventories. Chances are that the oil price will soon start rising as well.

Lower oil prices got some help from the recent dollar rally which now appears to be stalling. And with the summer driving season coming up, it looks like we’ll be facing $3.00 gasoline again.

Meanwhile, in Venezuela Hugo Chavez is working diligently to destroy that nation and turn it into a socialist wasteland, having recently devalued its currency by 50% and throwing merchants in jail who try to raise prices. Destroying business seems to be his goal, and along with that goes his oil industry, the production of which is down 33% from last year. Chavez is quite simply a madman, and it would not be at all suprising to see that nation explode or implode, bringing its current 2.4 mbd production off line. Now wouldn’t that do wonders for the price of fuel?

Its So Simple

The following is a comment by a reader of a financial web site. It is so to the point I filched it and reposted here:

“The system cannot be saved.

“Simple as that. Regulation WILL NOT SAVE IT.

“You cannot REGULATE AWAY mathematics.

“We have an exponential growth system which requires that credit continue to grow endlessly. Taking us back to where PEOPLE are the sole originators of credit is going to collapse credit outstanding and deflatively destroy the entire money supply.

“There is TOO MUCH DEBT out there and every last dollar of it REQUIRES interest service! That means that there must at some point be MORE debt elsewhere that finds its way into the hands of the payors in order to pay the interest service.

“A monetary-system-as-debt IS a forced exponential growth animal. There’s no way around this; I can demonstrate it in a minute as it is simple mathematics.

“Credit growth took off on its own when they figured out how to originate without using PEOPLE, iow, CDOs, MBSs, CDSs, and all the other synthetic instruments. Erecting “regulations” to stop this will collapse credit creation back to 40 years ago. Doing this would cause the EXISTING debts’ interest service costs to consume the entire money supply.

“All of this because of ACCOUNTING ENTRIES! We have let the fuckin bankers BECOME the barbarous relic strangling our society!

“If you review the anti-gold standard commentary more than 100 years ago, you see the same issues…an inability to find specie to service monetary needs imposed by DEBT.”

There is really little more to be said. This system is self-destructing beyond recovery.

The Stock Markets Will Crash

The stock markets are getting ready to crash again. And this time around there will be nothing left with which to bail it out except for worthless digital dollars passed out by the Fed to the still insolvent banksters, the megabanks whose bankrupt condition congress allowed to paper over with fantasy asset values. This is a road well traveled and well mapped; it needs no further elaboration.

As I predicted, after the Massachusetts elections, the administration and congress appears to be doing an about face, turning on their masters and biting them. We will see mock inquisitions and show trials before congress, yet before the ink is dry on the Presidents proposals, analysts responses that the proposals are little more than window dressing are pouring out. It really matters not whether the they are serious about reigning in the robber barrons, or the masters of the universe as they are often derided. The damage will be done in the form of the psychology of the market.

The health of the markets is the same as the banks, for the health of the market is phonied up in the same way as bank balance sheets. The economy is not recovering, it is getting worse month by month. Government also cooks its own books. Corporate revenues continue to fall all the while reporting rosy profits. How can this be? They are cannibalizing themselves to create appearances of sound health, that’s how. Here’s the proof:

15 stocks in the S&p have a P/E of over 100

23 have a P/E over 60

67 a P/E over 30

150 a P/E over 20

125 a Negative P/E

The last 125 are no doubt correctly priced, but the first 255, more than half the S&P are grossly overpriced. During all prior recessions P/E’s averaged around 8:1. What is holding this market up are the banks and the Fed and not even they can levitate the markets indefinitely. Sooner or later something happens to topple the house of cards. You may recall there was no big event that sent the markets crashing in August ’07 when the mortgage ponzi scheme finally imploded. The powers that be stopped the crash in the midst of free fall by means of the same sort of fraud and chicanery that caused the collapse in the first place, notably endemic corruption. That halt was only temporary, it will resume in the form of the much predicted second leg down reminiscent of the 1930’s.

The events that will put the final crash in motion have already begun. The epicenter of the shock was Massachusetts last Tuesday. These are shock waves that will ripple around the world.

The Future as I See It

I’ve been developing this vision of the future for several years now, having drawn on the ideas of many futurists. I don’t see all doom and gloom as many do, but rather a silver lining in the black cloud.

Anyone who was an adult in the 60’s and 70’s will recall how totally unpredictable the chain of events was during those years. There were widespread predictions of doomsday and Armageddon to such a degree that a president even gave a speech about the great malaise that had overtaken the nation (thanks to people like him ) The nation and the world faced numerous and very serious challenges, but ultimately sanity prevailed.

The end of the world as we know it didn’t happen, there was no nuclear war and USA didn’t fall apart. Overpopulation didn’t result in worldwide calamity. Here we are now 40 years later with a similar series of events and crises. But now a financial disaster faces the whole world which stems from the profound changes that took place 40 years ago. History is evolutionary.

All of our present circumstances basically resulted from the US emerging dominance after WWII and the arrogance of power that went along with it. What could have been more insane than the nuclear arms race? That arrogance of power is fueling the backlash that will ultimately cut it down to size. The glory days of American wealth and power are drawing to a close, lasting a mere 50 years. We will end up much like the collapse of the British empire which was also accompanied by severe financial problems. This is all to the good, a much needed adjustment.

Will the USA collapse? No, I don’t think so, there remains of this nation far too much wealth – both in terms of money and the dynamism of its people – for that to happen. We are corrupted, but not utterly corrupt. There yet remains much goodness in our people. The rest of the world has a love/hate relationship with us; we are not perceived as a totally evil empire but rather a misguided one.

I do not believe that there is any grand conspiracy by the elites. I can’t give them that much credit for being that smart, or organized. Rather, they just exploit conditions to their advantage as opportunities arise. Nowhere in history of nations do we find such such conspiracies. No, I think the behavior of the elites are simply misguided by amorality and greed, and like all such, they will destroy themselves. Caesar will end up with Brutus’s knife in his back. They always do.

The US will survive all this in a much humbled condition just as Britain did, and the good news is that I don’t think this will end up in a series of world wars as happened back then. Bad things will happen, to be sure. Maybe even a nuke will be set off somewhere in the world, but the futility of war is sinking into the minds of much of the world. Today it has advanced to Mutually Assured Destruction for all.

2010 is likely to be the pivotal year in which the 60 year status quo finally ends. The scenario I foresee is a repeat of the Great Depression without the world war that followed. The system of debt-money and the endless growth thesis that is required to maintain it has failed. It will be replaced by a new paradigm, a new economy in which technological advancement is no longer dominant and driven by constant, unending growth which is no longer possible due to resource scarcity and excessive populations. The global economy will not end but take a huge hit, scaling back by 50-75%. Import/export economies will no longer be viable; instead import nations will be forced back into self-sustaining economics; Americans will become poorer, the rest of the world richer.

Corporate, finance and investment structures will also undergo radical changes. Global corporations will die out quickly; nationalism will prevail. There will be trade wars and much fighting over resources; that’s never going to cease. Employment will evolve into a huge issue; I don’t see a bright future for free enterprise. We will end up looking more like Europe. It is a maxim that the larger populations grow, the more personal liberties shrink. That is inevitable, so get used to it. This doesn’t necessarily mean a lower quality of life. Your desire to do whatever you wish will be restrained.

We will be forced to live with less energy. We’ll be lucky to have one car in the driveway, yet alone two. I agree with Kunstler that there will be vast changes in the socio-economic layout of the nation. There will be huge migrations of people along with much social upheaval. The consumer economy is finished forever to be replaced by a self-sustaining economy or perish. Fifteen to twenty years from now the USA will more closely resemble the US of 1950 than of Y2K. And we will likely be happier and more mentally well balanced because of it.

Our so-called leaders are not Machiavellian conspirators. They are mostly ignorant, stupid, greedy people who are drunk on their own perceptions of illusory power. And most of them are laying the seeds of their own destruction. And while they think they are, they are not smart enough to organize a one world government. That’s a joke: these people can’t even agree on the time of day, yet alone organize a world government. The UN is proof of this impossibility.

Fiat currency will not come to an end, but the debt basis of that money probably will, replaced by some other arrangement, possibly by gold or other commodity backing. How this will play out is unknowable. The relative value of precious metals will increase dramatically but ultimately may end up in the hands of government exclusively as a monetary basis.

Default is the Answer

The question is, how do we get out of this mess? The truth is, we won’t. Political expediency will lead it where it has always led.

There will be no recovery of the U.S. economy because of the pervasive belief in the free lunch theory of economics that has led us down the same road as Japan. Let’s consider that nation, like the United States once considered an economic powerhouse. Just this week it was announced that Korean automaker Hyundai has exceeded Toyota in auto sales. Japan’s once invinceable car makers are now on the ropes and hurting badly as China gears up to take over from the fallen giant.

The Japanese economy collapsed in 1989 due to an enormous real estate bubble financed by excessive credit fostered by its central bank. Sound familiar? In 1990 the Nikkei reached an all-time high of 39,000; today, twenty years later it sits 75% lower right at 10,000. Japan has been in recession/depression for two whole decades, and the reason why is that the massive defaults from its collapsing markets were never recognized, never written off. They were carried on the books by the banks as good loans all these years when, in fact, the loans were not being repaid.

Why did they do this? Because they thought they could cheat the laws of math, have their cake and eat it too, and cover up the losses of dead banks indefinitely and they’d somehow miraculous resurrect themselves. The laws of math can’t be cheated any more than you can sit on fire and not be burned.

This is the same “solution” adopted by Barrack Husein Obama and his merry band of theives occupying the White House, as well as his predecessor. In addition to throwing a couple trillion of borrowed and printed money at the now bankrupt banks, they determined to sweep all the bad debts under the rug by changing the accounting rules so that banks could keep bad loans on the books as good loans. By the numbers, this makes the banks look solvent when, in fact, they are not.

As most readers know, the banks are not really lending, other than to hedge funds to speculate in the stock markets. The money lent by the Fed to the banks to keep them afloat was itself a new form of Ponzi Scheme. I apologize for the overuse of that term, but a rose by any other name . . . . . anyway, the money lent to the banks was for the purpose of the banks buying Treasury bonds since Uncle Sam was in acute danger of not being able to borrow nearly infinite amounts of money, so Bernanke & Friends cooked up this scheme, whereby the banks could deposit those bonds at the Fed as “excess reserves” on which the Fed would pay interest. As of May 2009, excess bank reserves totaled $840 billion; today they stand at $1.064 trillion and growing. But the banksters still are not lending despite the highest recorded reserve ratios in history. Why not?

Well, for one thing the banks are not really solvent due all those bad loans they carry on the books, and secondly there are no longer many credit worthy entities they would like to lend to. For some odd reason, the banksters suddenly became very prudent about lending. Apparently being broke has that effect on some people!

The banks are in this position because they have been insanely pushing credit down everyone’s throat with goading of our government in order to keep the Ponzi scheme economy going. A debt based money system is one that requires endless and infinite credit growth. Of course the flip side of credit growth is debt growth and only an idiot would think that debt could grow forever without disastrous consequences. This, naturally, has a lot to say about the general intelligence and integrity level of banking and politics. To wit, there is none.

Without bank lending, credit is shrinking dramatically; money is created by credit, so when credit shrinks, so does money supply. In saner times this is known as deflation, but that is a devil word not to be spoken by righteous men. So, when credit shrinks, the economy does likewise. To repeat, there are two reasons why the economy will remain trapped in depression. The first is bankrupt banks with trillions of bad loans on the books; the second is a populace that is hopelessly in debt and cannot repay those loans, or at least a too large percentage of them cannot. Ultimately, the bad debts on bank books will grow and grow, and loans will increasingly not be made, businesses will be starved for capital in an environment where the consumers are retrenching anyway, and on and on it will go just like Japan continues to do. Like flushing the toilet, it all spirals down the tubes.

There is yet a third element to the US situation that Japan does not have, which is the U.S. dollar as world currency. Like Japan, the US will try to bail itself out of this viscous circle by government stimulus . . . . borrowing and printing ever more money. The hope here is that inflation will erode away much of the debt overload. Unfortunately, this will not work because the end result will not be price inflation but dollar depreciation that ultimately must result in an international currency crisis and the death of the dollar, which will amount to the same thing as inflation, only in this case will be hyperinflation as the dollar looses upwards of 75% of its value. And when that transpires, any notion of the government engaging in deficit spending comes to a sudden end.

There is virtually nothing the government can do to fix the economy, any more that Bernie Madoff could extricate himself from his scheme; they can only succeed in making it worse. They merely rearrange the deck chairs on the Titanic while goading the band to play louder.

-

Archives

- March 2010 (1)

- February 2010 (4)

- January 2010 (4)

- October 2009 (8)

- September 2009 (6)

- August 2009 (17)

- July 2009 (16)

- June 2009 (19)

- May 2009 (13)

- April 2009 (12)

- March 2009 (12)

- February 2009 (16)

-

Categories

-

RSS

Entries RSS

Comments RSS

You must be logged in to post a comment.